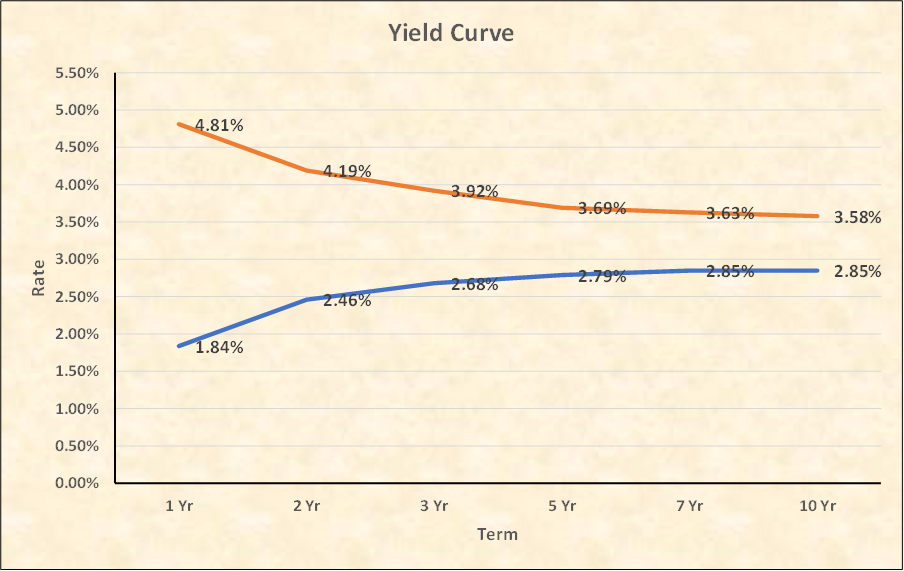

What a difference a year makes. In April 2022, the Wall Street Journal Prime Rate was 3.50%. The yield curve was normal, and commercial loan demand remained strong. At this point last year, the hot topic of discussion was where to set rate floors.

As of April 2023, the yield curve was inverted, pointing to a possible recession. Rates have dramatically increased, slowing loan demand, and inflation stubbornly hangs on indicating more rate increases could be on the way in the short-term. Customer demand has shifted the conversation from rate floors to rate ceilings. In addition, excess liquidity that resulted from the pandemic is now falling. This, combined with depositor demand for higher yields, is beginning to increase deposit costs.

The question becomes, how do we navigate our pricing strategy through these uncertain times?

In this blog, PRI consultant Shawn King discusses how to maximize profitability and ROE in an increasing rate environment.

Set rates that react to the market.

When interest rates are rising, financial institutions want to adjust as quickly as possible to maximize the rate hike’s potential profitability. While the WSJ Prime Rate is reactive and based on the Federal Funds Rate, set when the Fed meets eight times a year, King recommends using an anticipatory, more volatile index such as SOFR (Secured Overnight Financing Rate) that will react to market conditions more quickly. Since SOFR is based on having US Treasuries as collateral, it does not include a credit risk premium and is considered to be a more reliable benchmark than Prime because it’s based on actual transactions. King also suggests exploring Treasury Indexes such as the CMT for ARM loans.

“In terms of profitability, the SOFR index will adjust more quickly and increase profitability in a rising interest rate environment,” King said. “What goes up must come down, but this can be mitigated through rate caps and floors and prepayment penalties.”

Utilize floors and ceilings.

Given the rising rate environment, the borrower will most likely want a rate cap in place. The bank will need a floor to mitigate risk if rates begin to drop.

Use incremental pricing when negotiating rates.

When negotiating rates, use incremental pricing as opposed to eighths or quarters of a percent. An interest rate of 7.99% is a lot more palatable in many instances than 8.00%.

Include pre-payment penalties.

Prepayment penalties should be examined given the rising rate environment and exceptions to these penalties should only be made on rare occasions. When interest rates begin to fall again, the borrower will have a strong incentive to refinance. Prepayment penalties will slow the pace and compensate the bank for refinancing when rates begin to decline again.

Implement term sheets and commitment letters.

There is significant interest rate risk in the pending pipeline in a rising rate environment. Rates are committed to and then can change prior to closing. Don’t get into a bidding war! The term of a commitment letter should be kept to a minimum timeframe to prevent rate shopping and protect the bank against further rate increases in the pending pipeline. Commitment letter acceptance should be no longer than 10 days. On fixed rate loans, the commitment letter should have a stated limit for how long it is binding (30 – 60 days) after acceptance. Variable rate loans should be quoted as a margin over the index in the commitment letter.

Practice smart “entire relationship” customer service.

As an article in the Banker to Banker newsletter points out, providing superior service across the entire customer base is actually counterproductive. They write, “At most banks, only 10% of customers account for 120% of profits, and the remaining 90% of the customers subtract profitability from the bank.” Analyzing the “entire relationship” with the FI’s most profitable customers ensures it is concentrating its limited resources and efforts in the right place.

“In the current rising interest rate and credit environment, which is expected to last for the near future, banks that can correctly price loans and deposits, rank customer relationships based on profitability and then allocate service resources to harness such relationships will substantially outperform the industry.” – Banker to Banker

Resources:

What Relationship Pricing Means for Bank Performance, Banker to Banker

How to Prepare your Lending Organization for the Next Economic Downturn – Profit Resources, Inc

Profit Resources specializes in identifying profitability improvement areas for financial institutions through revenue growth, cost control, streamlining processes, and effective use of technology. Contact us to learn more about our personalized approach to propel growth and improve profitability.

Other Recent Articles

- Friendly Fraud: Legitimate Dispute or Regrettable Boots?

- The Power of Customer Education for Fraud Prevention

- Fraud Trends: 5 Common Tactics and How to Counter Them

- Unlocking the Secrets of High Performing Financial Institutions

- 4 Tips for Aligning Technology with Business Strategy

- Strategic Planning: Why You Should Include Future Leaders at the Table